Cars depreciate. Which is to say that they lose value over time. Why? Due to ongoing damage in the form of wear and tear over time – which given enough time and use will eventually lead to the car being declared unroadworthy – and the release of newer cars with the latest technology that people are more willing to buy instead of the older cars. Losing value off the lot The thing about cars, as you’ve probably heard before, is that they begin to depreciate the moment you drive them…

Read MoreAuthor: The MediFi Guy

The Car Salesman – a note on debt

Debt in general – one could argue in the overwhelming number of cases – is a bad thing. Why? Because being in debt makes you a slave to the lender. And a slave can never be financially free. Not only do you become a slave, but you also pay an extra premium for the privilege of being a slave. That premium is called “interest”. The price you pay for borrowing money. If one intends to one day achieve financial independence, it naturally follows that one should aim to avoid debt…

Read MoreThe Car Salesman – an overview

Try this quick experiment. Google “worst financial mistakes you could ever make”. Open up the first 10 or so articles/forum posts/blog posts, and do a quick scroll through. You’ll soon notice a trend. Of the many mistakes listed, there always seems to be one in particular that appears on virtually every single list. Usually listed as the number one possible mistake: buying a brand new car. Why is this? The reasons buying a new car is considered to be pathognomonic of poor financial management are as follows: 1) Debt 2)…

Read MoreThe Financial Advisor – a note on the guaranteed loss

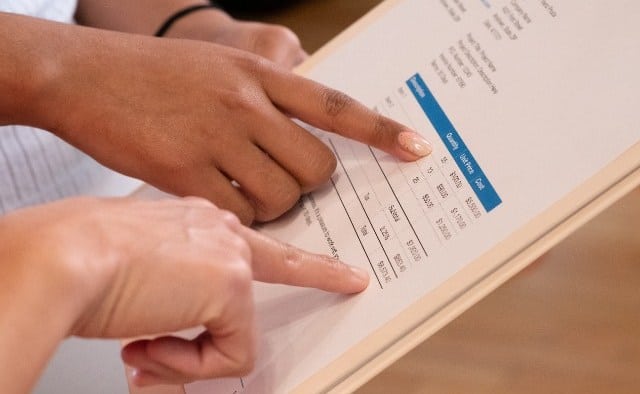

You are guaranteed to lose money if you have a financial advisor “Alright, so I kind of understand the point about fees and stuff, but aren’t you being a bit hyperbolic when you say that you’re guaranteed to lose money? Surely that can’t be the case?” Let us revisit our previous example again: Notice the rate of return of “6%”. What does that mean? For this discussion, we’ll assume that the 6% is a *real return. *Tip: whenever you see “real x” in finances, it means x after you subtract…

Read MoreThe Financial Advisor – a note on Fees

Fee Fees Fees! One of the most important things to understand when it comes to investing. “How can I know whether something I invest in will have a good return?” Fees! Low fees have been shown to be the best predictor of a high future return. A better predictor than past performance, current performance, or any theoretical future predicted performance. Low fees are the only proven consistent predictor of a good future return! Knowing this, it is imperative that you keep your investment fees as low as humanly possible when…

Read MoreThe Financial Advisor – a note on Incentives

Many financial advisors are linked to particular companies and are authorized to sell the products of that company. Every time they successfully sell the product, they receive a commission from the sale. That’s why in many cases it’s free to meet and talk to a financial advisor. They get paid by the company once they successfully sell you the product. This incentivizes the FA to push a whole host of products onto you that may have little to no benefit to you given your circumstances, and at worst may actively…

Read MoreThe Financial Advisor – a note on Jargon

Hey, med student bro! How’s your net worth looking nowadays? I’ve been thinking of dollar cost averaging into a total return stock market index-linked ETF in my tax-advantaged accounts, but I’m not happy with the level of intra-asset class diversification within the fund. Maybe it’s the market cap weighting they’re using? Not to mention I find the small hedge fund allocation a bit unsettling. Maybe I should consider de-risking a bit and adding an inflation-linked bond index fund as well? However, the bond yields have been on a downward trend…

Read MoreThe Financial Advisor – an overview

The Four Horsemen of your Financial Apocalypse: The financial advisor The car salesman The private banker The insurance broker The Financial Advisor “What’s wrong with having a financial advisor? Shouldn’t I get an expert to help with all this confusing financial stuff? I mean if you can’t do something yourself, you hire an expert to do it for you, right?” The reasons you should carefully consider whether the services of a financial advisor are in your best interest before signing up with one can be summarised as follows: 1) Everything…

Read MoreA Message to Final Year Medical Students

You now find yourself at a critical transitional period, a few months before formally starting work with the promise of one of the highest starting salaries in the country. A period wherein you will become the target of a host of financial services professionals. These professionals are banking on your lack of knowledge regarding basic personal finance and investing concepts (which the majority of new doctors tend to be ignorant of) and will try anything within their means to capitalize on your ignorance in order to secure as large a…

Read MoreWhat is Financial Independence?

Simply put, working because you want to, not because you need to, is Financial Independence. The way the world works, whether we like it or not, is that money is the means by which you attain the freedom of choice to live the way you want to. The vast majority of people work because they have to work, not because they want to, nor do they enjoy the work that they do. The reality is that they don’t have the choice not to work. Ask yourself this, if choosing not…

Read More