Last Updated on July 30, 2022 by The MediFi Guy

Following on from our previous discussion of Tax-Advantaged Investment Accounts, we’ll now cover the two Types of Tax-Advantaged Accounts in South Africa. These are the Retirement Annuity and the Tax-Free Savings Account.

The Purpose of Tax-Advantaged Accounts

As we’ve touched on before, the government created tax-advantaged accounts to encourage people to save for their own retirement. They do this by offering incentives in the form of tax deferrals and exemptions not offered by traditional investment accounts. Taxes are the single largest expense one incurs over their lifetime. As such, the tax benefits offered by these accounts are the best means of reducing this expense.

The State’s Conundrum

The use of these tax benefits, whilst effective in incentivizing the public to save, creates a problem for the state. The state needs money in order to govern and perform its functions and that money has to come from somewhere. But if it creates a type of investment account that allows people to invest without paying taxes, what’s to stop members of the public from using that account as their main or only investment vehicle? In doing so they could then avoid paying taxes altogether, causing a large drop in the total amount of revenue the state can collect. It makes sense that individuals would attempt to do this if permitted. People tend to look out for their own self-interest (avoiding taxes) regardless of the harmful impact it might have on others (fewer taxes available to fund public services).

Furthermore, there’s also the risk that people could invest all their money in foreign or offshore assets. In such a case, not only does the state lose out on collecting taxes, but the local economy as a whole loses out on domestic investment. How can the state prevent these tax-advantaged accounts from being abused this way? What’s the solution?

The Solution – Rules and Regulations

The solution is to regulate the accounts in the following ways:

- Placing limits on the maximum amount one can invest in the accounts

- Stipulating which securities one can invest in, to what extent, and in which geographical location

- Stipulating when and how one can withdraw money from the accounts

- Regulating the tax deferrals and exemptions on the accounts

We will now see how each of these regulations applies to Retirement Annuities and Tax-Free Savings Accounts.

Retirement Annuities

Retirement Annuities (RAs) are governed by a section of the Pension Funds Act called Regulation 28. The key stipulations of Regulation 28 you should be aware of are as follows.

#1) Placing limits on the maximum amount one can invest in the accounts

Investors are only allowed to invest up to 27.5% of their taxable income in a retirement annuity on a tax-deductible basis, and up to an annual maximum of R350 000. What this means is that of all the money you contribute to the RA, the lesser amount of 27.5% of your annual income vs R350 000 is what is subject to the tax benefit. For example:

Scenario A:

Your annual income is R600 000.

27.5% x R600 000 = R 165 000.

If you compare R165 000 to R350 000, R165 000 is the lesser of the two.

Therefore the amount that you can contribute which will be eligible for tax benefits is R165 000.

Scenario B:

Your annual income is R10 million.

27.5% x R10 million = R2 750 000.

If you compare R2 750 000 to R350 000, R350 000 is the lesser of the two.

Therefore the amount that you can contribute which will be eligible for tax benefits is R350 000.

#2) Stipulating which securities one can invest in, to what extent, and in which geographical location

The extent to which one can invest in certain securities and how much must be domestic vs foreign investment is stipulated by Regulation 28. Broadly speaking, the rules regarding asset allocation are as follows:

- a maximum of 75% of your retirement savings in shares

- a maximum of 25% in property

- 30% in international assets excluding Africa

- 40% in international assets including Africa

For any RA fund, the percentage of the existing investment and any future contributions allocated to the fund must be such that the total investment fund stays within the above limits, ie the fund must frequently be rebalanced to stay within the limits.

Individual investors are free to take a “do-it-yourself” approach to their RA and manually select which securities to invest in and go about rebalancing regularly as required by Regulation 28, but this would be a massive undertaking requiring untold time, effort, and resources to ensure that you are constantly within the requirements of the law. The better approach is to invest in what is called a “Balanced Fund”.

A Balanced Fund is a type of investment fund that automatically rebalances its asset allocation to always fit within the limits of Regulation 28. This is referred to as being Regulation 28 compliant. The investment company fund manager does the job of ensuring that the fund is frequently rebalanced, and all the individual investor has to do is to contribute to the fund.

Balanced Funds are usually named in a way that includes a number in the name. The number tells you the equity allocation of the fund. For example, in South Africa, there are balanced funds such as the “Sygnia Skeleton Balanced 70 Fund” which is a Regulation 28 compliant balanced fund with 70% of its asset allocation in equities. They state the number so that you can get an idea of the risk exposure of the fund. The higher the number, the higher the equity allocation, and the higher the risk.

#3) Stipulating when and how one can withdraw money from the accounts

You are allowed to withdraw funds from a Retirement Annuity starting from the age of 55. The only instances where you are permitted to withdraw funds before age 55 are in the event that you become medically disabled, emigrate from the country, or are forced to leave the country when a visa or work permit expires.

Upon reaching the age of 55, you are permitted to withdraw the entire RA benefit as a cash lump sum if the total benefit amount is R247 500 or less. If it is more than R247 500, you are allowed to withdraw only one-third of the total retirement benefit as a cash lump sum. The remaining two-thirds of the benefit must be used to buy an annuity product – either a Guaranteed Annuity or a Living Annuity.

Guaranteed Annuity

A Guaranteed Annuity is a type of pension product that gives you a guaranteed income for the rest of your life by essentially paying you a monthly “salary” after retirement until you pass away. The monthly “salary” amount that you get depends on the value of that 2/3rds RA benefit you used to buy the guaranteed annuity, as well as on the terms and conditions of the annuity product. The institution that you buy the Guaranteed Annuity from decides how to invest the money in return for giving you a guaranteed monthly income.

In general, you tend to have little control over what that monthly income will be and no freedom to change the amount after you buy the guaranteed annuity. Also, your heirs won’t be able to receive whatever you leave behind in the guaranteed annuity when you pass away. In other words, when you die, your capital does too. So you’re guaranteed to have an income until you die, but if you die earlier than expected the institution keeps the remaining money and your heirs get nothing.

Living Annuity

A Living Annuity is similar to a guaranteed annuity, except that with a Living Annuity you have the freedom to select your annual income (within the bounds of certain legal restrictions) and the investments made with your money. Any money that is left over after your death goes to your heirs. You do, however, accept the chance that you may outlive your savings and run out of income before you pass away, and also run the risk that the investment returns of your chosen investment will be subpar and result in losses that might cause you to run out of income as well and find yourself destitute. You have more freedom, with the risk that you could outlive your savings or that your salary in the future won’t keep up with inflation, but you are able to pass on any remaining money to your heirs when you pass away.

#4) Regulating the tax deferrals and exemptions on the accounts

Retirement Annuities are “tax-deferred” accounts, meaning that the taxes payable are delayed until a later date. The benefit of the taxes being deferred until later is that you avoid paying high taxes now, and instead pay lower taxes later.

Before Retirement

Prior to retirement whilst making contributions to the Retirement Annuity you are exempt from paying taxes on the money that is contributed (up to a maximum of 27.5% of your yearly income or R350 000 annually, whichever of the two is lower) and are exempt from paying taxes on the profits that the investment makes.

To give a practical example of what this means, let’s say that you as a Medical Intern decide to open an RA and make contributions. The maximum amount you can contribute that is eligible for a tax exemption is the lesser of 27.5% of your annual income or R350 000. If your yearly income is R670 000, then the maximum tax-exempt amount you can contribute per annum is 27.5% x 670 000 = R184 250 (which is the lesser value of 27.5% of income vs R350 000).

If your income happened to be a lot more, let’s say R 10 million per annum, then in that case 27.5% x R 10 million = R 2.75 million. Since R2.75 million is more than R350 000, you would only be eligible to contribute a tax-exempt amount of R350 000 (which is the lesser value of 27.5% of income vs R350 000).

This tax exemption is processed as a tax refund when you file your tax returns in a similar fashion to the “correcting a mistake” type of tax refund discussed in the article Why do First Year Medical Interns get a Tax Refund? In simple terms, by the time your salary reaches your bank account income tax has already been deducted in the form of PAYE tax. When you then use that money to contribute to a Retirement Annuity, you are contributing money that shouldn’t have been taxed, since RA contributions are supposed to be exempt from taxes.

In order to fix this “mistake” of having incorrectly taxed the money, you submit a Retirement Annuity Contributions statement to SARS detailing the contributions that you made, and SARS refunds you the taxes that were incorrectly deducted from those amounts. The refund amount is calculated by multiplying the total amount of contributions by your marginal tax rate. Interns fall into the tax bracket with a marginal tax rate of 39%. Therefore whatever amount you contribute, multiple that by 39% to calculate the tax refund. That’s why you get a tax refund for Retirement Annuity contributions when you file your tax return.

The investments within the Retirement Annuity are also completely exempt from the usual revenue tax, capital gains tax, and dividends tax that would be payable if the money had been invested in a normal discretionary investment account.

After Retirement

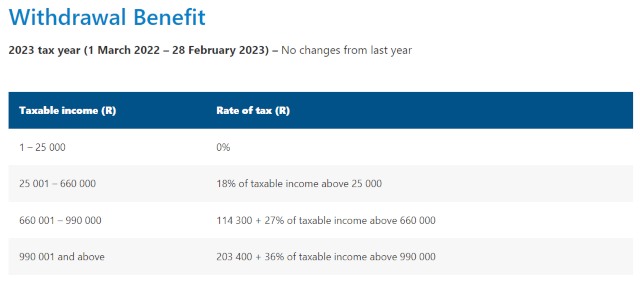

As previously mentioned one is allowed to withdraw one-third of the RA as a cash lump sum. If this lump sum is below the minimum tax threshold of R25 000, you don’t pay any taxes on it. If it is more than the R25 000 minimum threshold, the amount above the R25 000 is taxable. From R25 000 – R660 000 the tax rate is 18%. From R660 000 – R990 000 the rate is 27%. Over R990 000 the tax rate is 36%.

The two-thirds used to buy an annuity product is taxable if it exceeds a certain threshold, and is subject to retirement tax rates above. The tax thresholds are as follows:

For the 2023 year of assessment (commencing 1 March 2022 and ending 28 February 2023):

- Person below the age of 65 – R91 250 per annum

- Person aged 65 and above but not yet 75 – R141 250

- Person aged 75 and above – R157 900.

For example, if your annuity income was R40 000 a month (or R480 000 per annum) at age 65, your taxable income is only R338 750 (R480 000 less the R141 250 exemption). This taxable income amount of R338 750 is applied to the retirement tax table:

With a taxable income of R338 750, your tax rate would fall into the lowest bracket of 18%. Therefore your tax payable would be 18% x R338 750 = R60 975 per annum. So your net annual income would be R480 000 – R 60 975 = R419 025 per annum or R 34 918.75 per month.

As you can see, by deferring the taxes until after you have retired you manage to avoid paying the 39% marginal tax you would have paid whilst working along with taxes on investment profits (which can range from an additional 18 – 39%), and instead end up paying only 18% tax on the money after retirement.

Tax-Free Savings Accounts

The rules governing Tax-Free Savings Accounts (TFSAs) are thankfully a lot simpler than those governing RAs, so we won’t spend too much time on them. Tax-Free Savings Accounts were introduced fairly recently in 2015 as a means of supplementing retirement savings. Calling it a “savings account” is something of a misnomer, as the account is meant for long-term investing, but that’s the name it was given so we’ll stick with it.

They were intended to encourage extra savings in addition to the Retirement Annuity. Some people choose to use them as a replacement for the RA because they offer a lot more freedom and flexibility than RAs. Others do so because they only have enough income to afford to contribute to one of them, being forced to pick between either using an RA or a TFSA. As a doctor, your income poses no such affordability concerns. You can afford to use them both.

#1) Placing limits on the maximum amount one can invest in the accounts

As an investor, you are only allowed to invest a maximum of R36 000 per tax year into a Tax-Free Savings Account, with a lifetime limit of R500 000. You can contribute the yearly maximum amount of R36 000 as a once-off lump sum deposit, or divide it into deposits throughout the year, just as long as the total of all deposits combined does not exceed R36 000.

The yearly limit of R36 000 does not carry over into the next tax year, and if you withdraw any money from the TFSA during a tax year you cannot deposit more into it if you have already met the yearly limit with your previous contributions. If you exceed the R36 000 limit, you pay a penalty to SARS of 40% of the amount above R36 000 that you contributed. A few examples to illustrate the rules:

Scenario A:

You decide to make equal monthly deposits of R3 000.

R3 000 x 12 = R36 000.

You are within the limit of R36 000.

Scenario B:

You decide to make a once-off lump sum deposit of R36 000.

You are within the limit of R36 000.

Scenario C:

You decide to make a lump sum deposit of R36 000.

You have met the limit of R36 000

Halfway through the same tax year, you withdraw R10 000.

In this scenario, you are not allowed to deposit any more money into the TFSA to make up for the R10 000 withdrawal (ie you cannot deposit another R10 000 into the account) because you already used up the R36 000 limit when you made the initial lump sum deposit in the beginning. You have to wait for the next tax year to have another chance to deposit R36 000.

Scenario D:

You deposit a lump sum of R 30 000 in the current tax year.

The limit of R36 000 has not yet been met. You are still permitted to deposit R6 000.

The tax year ends without you making the remaining R6000 deposit.

In the following tax year, you deposit a lump sum of R36 000. You have met the limit of R36 000. You are not allowed to deposit an additional R6000 to make up for the R6000 limit that went unused the previous year, since that would push your total contributions to R42 000 (R36 000 + R6000) which exceeds the limit of R36 000 for a tax year.

If you were to go ahead and deposit an extra R6000 anyway, in contravention of the rules, you would pay a fine of 40% of that amount above R36 000 as a penalty, which is equal to a penalty of R2 400 in this case.

If one keeps within the legal limits of R36 000 per annum, you will reach the lifetime maximum contributions of R500 000 in about 14 years (R500 000/R36 000). At that point, you are not permitted to make any further contributions. From then on the investment can either be left to continue growing or be withdrawn for use.

#2) Stipulating which securities one can invest in, to what extent, and in which geographical location

In contrast to RAs, there are no rules governing the make-up of TFSAs. Investors are free to invest in whichever securities they want, to any extent they want and in whichever geographical location they choose. There are no Regulation 28 style limits placed on TFSAs.

#3) Stipulating when and how one can withdraw money from the accounts

Investors are free to withdraw money at any point from a TFSA and use it however they choose. There are no restrictions on withdrawals and use as is the case with Retirement Annuities. It should however be noted that, as previously mentioned, any money withdrawn cannot be replaced if you have already met the contribution limits of R36 000 per annum with a lifetime total of R500 000.

#4) Regulating the tax deferrals and exemptions on the accounts

Tax-Free Savings Accounts are “tax-exempt” accounts. What this means is that you pay income tax (PAYE) on the money prior to it entering the account. Once inside, the investment is exempt from taxes on its profits as well as from income taxes on any future withdrawals. This is in contrast to “tax-deferred” Retirement Annuities, where you don’t pay any income tax on the money before it enters the account, and no taxes on the profits, but have to pay income tax (at a lower rate) at a later date after you retire and start withdrawing the money.

Before Retirement or Withdrawal

The concept of “retirement” as a set point in time or as a specific retirement age doesn’t really apply to TFSAs, since you are free to withdraw money at any point. Nevertheless, the way the tax benefit works in practical terms is that the money you contribute to the account is “post-tax” money. It is the money you are paid that has already undergone a deduction of PAYE income tax prior to it landing in your bank account. You have already been taxed on the money. That post-tax money is invested and allowed to grow in the account, and you are not required to pay any dividends tax, capital gains tax, or revenue tax on the profits of that growth. The investment growth is completely tax exempt.

The TFSA tax benefit rules do not cause SARS to “incorrectly” tax you at any point since post-tax money used to make the investment is supposed to be post-tax money. Therefore unlike with RA contributions which are meant to be pre-tax and therefore eligible for a tax deduction, you do not get any tax refunds from SARS for making TFSA contributions.

After Retirement or Withdrawal

Any money withdrawn from the account is tax-exempt. It is not subject to any income taxes, and you are free to spend it however you wish.

As you can see, when it comes to TFSAs the only tax you ultimately pay is the normal income tax on the money prior to investing it in the account (at a marginal tax rate of 39% in the case of interns), but from then on you never have to pay any taxes on it ever again.

Conclusion

In summary, Retirement Annuities and Tax-Free Savings accounts are investment vehicles that the government introduced to encourage retirement savings. They offer great tax incentives and greatly reduce the amount of taxes one incurs over their lifetime. Retirement Annuities have stricter rules governing their use, whilst Tax-Free Savings Accounts offer more freedom and flexibility. Nevertheless, when used in conjunction they are useful in ensuring that you have enough money to live comfortably during retirement.

Legal Disclaimer: The information on this website including research, opinions or other content is not intended to and does not constitute financial, accounting, tax, legal, investment, consulting or other professional advice or services. The author of this blog does not act or purport to act in any way as a financial advisor or in a fiduciary capacity. Prior to making any decision or taking any action, which might affect your personal finances or business, you should take appropriate advice from a suitably qualified professional or financial adviser.