Last Updated on July 24, 2022 by The MediFi Guy

Now that we’ve gained an understanding of what Index Funds are, we can build on that foundation to explain “pooled funds” as they are very similar concepts. When it comes to investing (ie buying an asset such as a stock or bond), there are different ways one can go about it. One way is to invest in an individual asset, for example investing in shares of company “x”, by opening an investment account and buying the shares. Another way is to use what is referred to as pooled funds. In South Africa, pooled funds come in the form of Unit Trust Funds and Exchange Traded Funds.

What are Pooled Investment Funds?

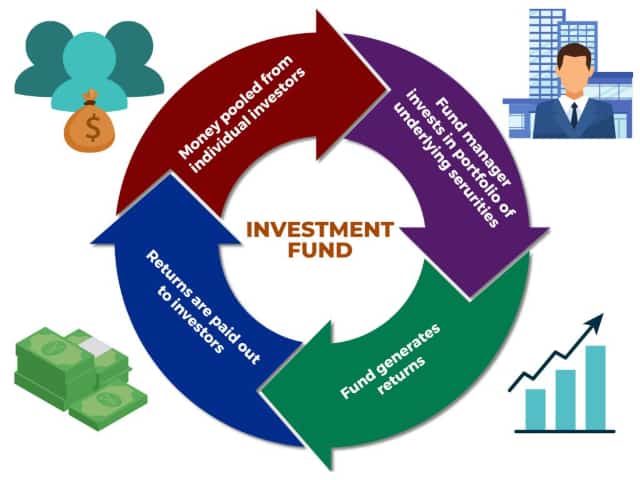

Pooled funds refer to money that has been collected for investing purposes from a variety of different individual investors and placed into a single investment portfolio. The way a pooled fund works is very similar to what we’ve already covered regarding index funds, matter of fact, an index fund is a type of pooled based around the theme of tracking a market index. A pooled fund involves an investment company creating an investment portfolio that contains a collection of securities centered around a particular theme. These securities can be from any asset class depending on the portfolio’s objective.

They then offer the market the option of investing in this fund. Individuals can then invest in the fund by depositing money into it, and the investment company collects the money from all the individual investors and uses it to purchase the underlying assets that make up the portfolio on the behalf of the investors.

The investment firm manages the investment but the underlying assets belong to the individuals who invested in the fund. The returns of the fund belong to the investors, who can reinvest the returns or redeem their investment and withdraw money from the fund. The investment firm is responsible for the management of the fund (deciding the make-up of the portfolio, buying the assets with the money pooled from investors, selling and distributing or reinvesting returns, etc) and is compensated for its services in the form of management fees.

A simple way to think of an investment fund is as a “bundle” of assets wrapped together in a single package, assets that are chosen to achieve a particular goal, which investors can purchase as a whole. An index fund is a pooled fund that is based on the idea of tracking a particular market index. The investment company creates a portfolio that matches the index and offers it to investors, who then purchase the bundle and use it as a vehicle to invest in the entire market.

There are countless different funds with different themes in existence, for example, there can be funds that only include businesses in a particular industry (eg tech company funds), funds that include companies of a particular size (eg large-cap funds and small-cap funds), funds that include companies growing at a certain rate (eg growth funds) and many more, but the main concept one needs to grasp is that a fund is a bundle of securities.

In the South African context, the relevant types of Pooled Funds one needs to be aware of are Unit Trusts, and Exchange Traded Funds

What are Unit Trusts?

A unit trust is a type of collective pooled investment fund that pools the funds of individual investors to buy different securities, such as stocks or bonds. The portfolio of securities is divided into equal portions or “units” and managed as a single unit trust fund. When you buy a share in a unit trust, you acquire ownership of units of the portfolio, each of which represents a proportionate part of the assets that underlie the portfolio.

The price of a unit trust is determined by dividing the market value of the underlying assets by the number of units that have been issued. Unit trusts are not listed on any exchanges like the stock exchange and are only priced and traded (able to be invested in or sold) once a day after the markets have closed.

The vast majority of unit trusts are actively managed, although there does exist a small number of passively managed index-based unit trusts. Due to the nature of active management, which requires more labor to choose the best securities to meet the portfolio’s plan, management costs for unit trust funds are often higher than other types of funds. Therefore unit trusts as an investment are best suited for use in non-retirement, discretionary investment accounts.

What are Exchange Traded Funds (ETFs)?

An ETF is a type of pooled investment fund that is listed and traded on a stock exchange in the exact same way that stocks are, hence the name “exchange-traded fund”. Think of it as a “bundle” containing underlying securities, but in this case, the bundle is placed in a container called an ETF that can be listed on a stock exchange as if it were a single stock. This allows the ETF to behave just like a stock and be bought and sold on the stock exchange. When someone trades it, they are buying or selling the entire package of securities as a single entity.

Since the package is traded as if it were a stock, it has a “share price” that fluctuates all day as the ETF is bought and sold, and also as the individual securities that make up the fund are bought and sold elsewhere in the market. This is different from unit trusts, which only trade once a day after the market closes.

There are many different types of ETFs, each with a particular set of goals, just like there are different types of unit trusts. Some ETFs such as index funds aim to track the performance of a particular market index like a stock index or bond index. Others may aim to track a specific market sector or industry.

Nevertheless, as opposed to unit trusts which tend to be actively managed, the vast majority of ETFs tend to be passively managed. Due to the nature of passively-managed investing requiring less in terms of labor, the management costs of ETFs are often significantly less than those of unit trusts. Therefore passively-managed ETFs are best suited for use in long-term retirement investing in tax-advantaged investment accounts.

Legal Disclaimer: The information on this website including research, opinions, or other content is not intended to and does not constitute financial, accounting, tax, legal, investment, consulting, or other professional advice or services. The author of this blog does not act or purport to act in any way as a financial advisor or in a fiduciary capacity. Prior to making any decision or taking any action, which might affect your personal finances or business, you should take appropriate advice from a suitably qualified professional or financial adviser.