Last Updated on July 24, 2022 by The MediFi Guy

Tax season is upon you, and you’ve been hearing talk amongst your fellow interns about a tax refund that you’ll all be receiving from SARS. Everyone seems quite certain that it’ll be happening, but whenever you ask one of them to explain why you’re all somehow getting a refund even though you only recently started working the answers you get range from “I don’t know” to the unsatisfactory and never elaborated upon “because we overpaid tax”. If any of this rings true for you and you’d like to find out the real reason then you’ve come to the right place, as this article will discuss in detail why first-year interns can expect a tax refund from SARS.

The Tax Year

A normal calendar year runs from the beginning of January to the end of December. This is different from the tax year. The tax year runs from the beginning of March until the end of February the following year (for individual taxpayers). The tax year is named according to the year in which it ends, for example, the 2022 tax year is the tax year that ran from 1 March 2021 to 28 February 2022. The following tax year, from 1 March 2022 to 28 February 2023 is called the 2023 tax year, and so on. You don’t need to know why the calendar year and tax year don’t coincide to understand where the refund comes from. All you need to know is that the tax year is a 12-month period beginning in March and ending in February.

The Tax Threshold

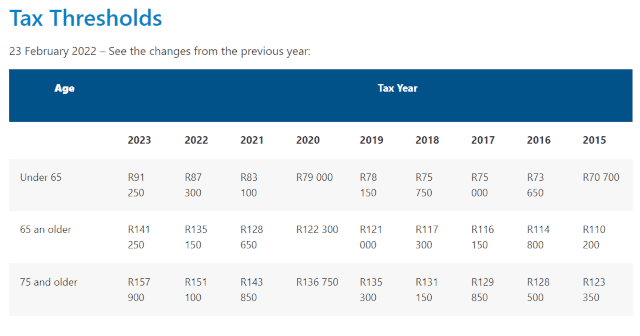

In order to qualify for income tax, your income first needs to exceed the tax threshold. The tax threshold is the amount above which income tax becomes payable. If you earn less than the threshold you don’t pay any income tax. These are the most recent income tax thresholds:

As you can see the income tax threshold for the 2022 tax year was R87 300 per annum for interns as they form part of the “under 65” category. Since interns earn more than R87 300 per annum they qualify to pay individual income tax.

The Tax Bracket

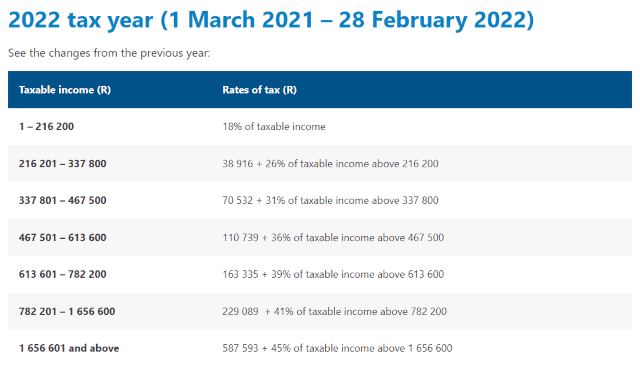

Once you meet the tax threshold your income tax payable is then determined by your income tax bracket. These are the tax brackets for the 2022 tax year:

For ease of calculation, I’ll use an annual intern salary of R 672 000 per annum (or R56 000 per month) as an example to illustrate the point.

According to the above tax brackets, an intern salary of R 672 000 per annum falls within the R613 601 – R782 200 bracket. In this bracket, the tax rate payable is R 163 335 + 39% of taxable income above R 613 600. We will use these figures to now illustrate the calculation that leads to the refund.

The Individual Income Tax Calculation

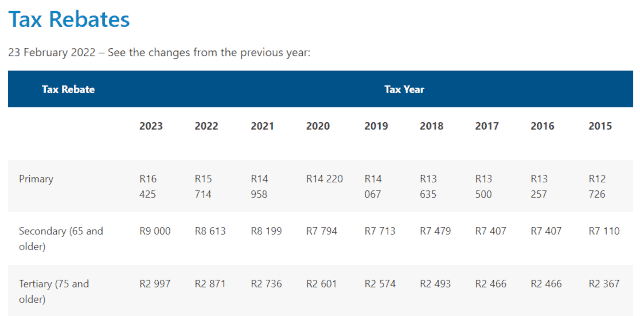

The way SARS calculates tax is that they take your monthly salary and multiply it by 12 to get an annual salary. The annual salary is used to see which tax bracket you fall under, and your total annual tax is calculated based on your bracket. An amount called the Tax Rebate is then subtracted from the total tax that was calculated (the Tax Rebate is an amount by which SARS reduces the actual taxes owing depending on your age). These are the most recent tax rebates:

The tax rebate that applies to interns is the Primary Rebate of R15 714 for the 2022 tax year. After subtracting the rebate from the annual tax amount, SARS then divides the resulting number by 12 to get a monthly PAYE tax which is deducted automatically from every monthly paycheck. You can see this PAYE tax deduction on your monthly payslips.

So the steps are:

- Monthly Salary x 12 = Annual Salary

- Annual Salary used to find tax bracket and calculate tax

- Rebate subtracted from the calculated annual tax amount

- Total Annual tax / 12 = Monthly Tax

- Monthly tax deducted from pay every month in the form of PAYE tax

Let’s use our example of a salary of R56 000 per month or R672000 per annum:

- R56 000 per month x 12 = R672 000 per annum

- Based on the tax bracket:

- R163 335 tax is immediately payable

- In addition to this, 39% of taxable income above R613 600 is payable

- Therefore R163 335 + [39% x (R672 000 – R613 600)] = R186 111

- Total Annual Tax Payable = R186 111

- R186 111 – R15 714(rebate) = R 170 397

- R170 397 / 12 = R14 199.75 monthly tax payable

- Therefore the monthly PAYE deduction reflected on the payslip will be R14 199.75

This is how SARS calculates your tax. The method of calculation assumes that you will work the full 12 months of the tax year and the entire calculation is based on that assumption. This calculation works perfectly if you do work for the full 12 months, but what happens if you don’t? What happens if you’re an intern who only worked for 2 of the 12 months of the tax year?

The Problem with the Tax Calculation

As mentioned earlier, the tax year runs from March to February. Therefore in the case of Medical Interns who start work on the 1st of January, their first two months of work (January and February) are in fact the last two months of the tax year, which ends on the last day of February. So first-year interns work for the last 2 out of the 12 months of the tax year.

Nevertheless, the PAYE tax deducted from the January and February salaries is calculated using the above method which assumes that you would have worked for the full 12 months of the tax year (as seen in the very first step of the calculation which is to multiply your monthly salary by 12). This is therefore an incorrect assumption in the case of interns who only worked for 2 months. As a result, the calculation is in a sense “incorrect” when applied to interns. A “mistake” has been made, and SARS has deducted an incorrect amount of tax for those two months.

The Solution to the Problem

So how does SARS correct this mistake? The first thing they do is re-calculate your tax, but this time using the correct starting assumption of only two months worked:

- R56 000 per month x 2 = R112 000 (total salary received over the two months you actually worked)

- Based on this new total salary, a lower tax bracket is chosen. According to the new bracket:

- 18% of taxable income is payable

- Therefore 18% x R112 000 = R20 160 Total Annual Tax Payable for the tax year

- R20 160 – R2619 (rebate for two months) = R17 541

- R17 541 / 2 = R8 770.50 monthly tax payable

- Therefore the monthly PAYE deduction that SARS should have been deducting is only R8 770.50

After re-doing the calculation and arriving at the correct amount that you should have been taxed – R8 770.50 per month – SARS then compares the correct amounts to the incorrect amounts that they deducted:

Incorrect amounts:

- R14 199.75 for January

- R14 199.75 for February

- Total = R28 399.50

Correct amounts:

- R8 770.50 for January

- R8 770.50 for February

- Total = R17 541

So when compared, SARS deducted a total of R28 399.50 whereas they should have actually deducted a total of R17 541. (R28 399.50 – R17 541) = R10 858.50 extra SARS deducted that they shouldn’t have. The way SARS “corrects” this error is by REFUNDING you the extra money that they deducted from you, in the form of a Tax Refund when you submit your 2022 tax return. That’s where the tax refund comes from. That’s how one ends up getting an unexpected R10 858.50 tax refund from SARS (using the above example salary).

Conclusion

Now that you understand the reasoning behind it you can go ahead and calculate your own refund using your payslips. Just remember that since the refund is a result of a quirk in the way the tax calculation is made, coupled with the fact that you only worked for a small part of the tax year, you won’t be getting a similar refund in your second year of internship since by the same time next year you will have actually worked a full 12 months of the tax year in question (March – February).

I hope that clears everything up for you!

Legal Disclaimer: The information on this website including research, opinions or other content is not intended to and does not constitute financial, accounting, tax, legal, investment, consulting or other professional advice or services. The author of this blog does not act or purport to act in any way as a financial advisor or in a fiduciary capacity. Prior to making any decision or taking any action, which might affect your personal finances or business, you should take appropriate advice from a suitably qualified professional or financial adviser.